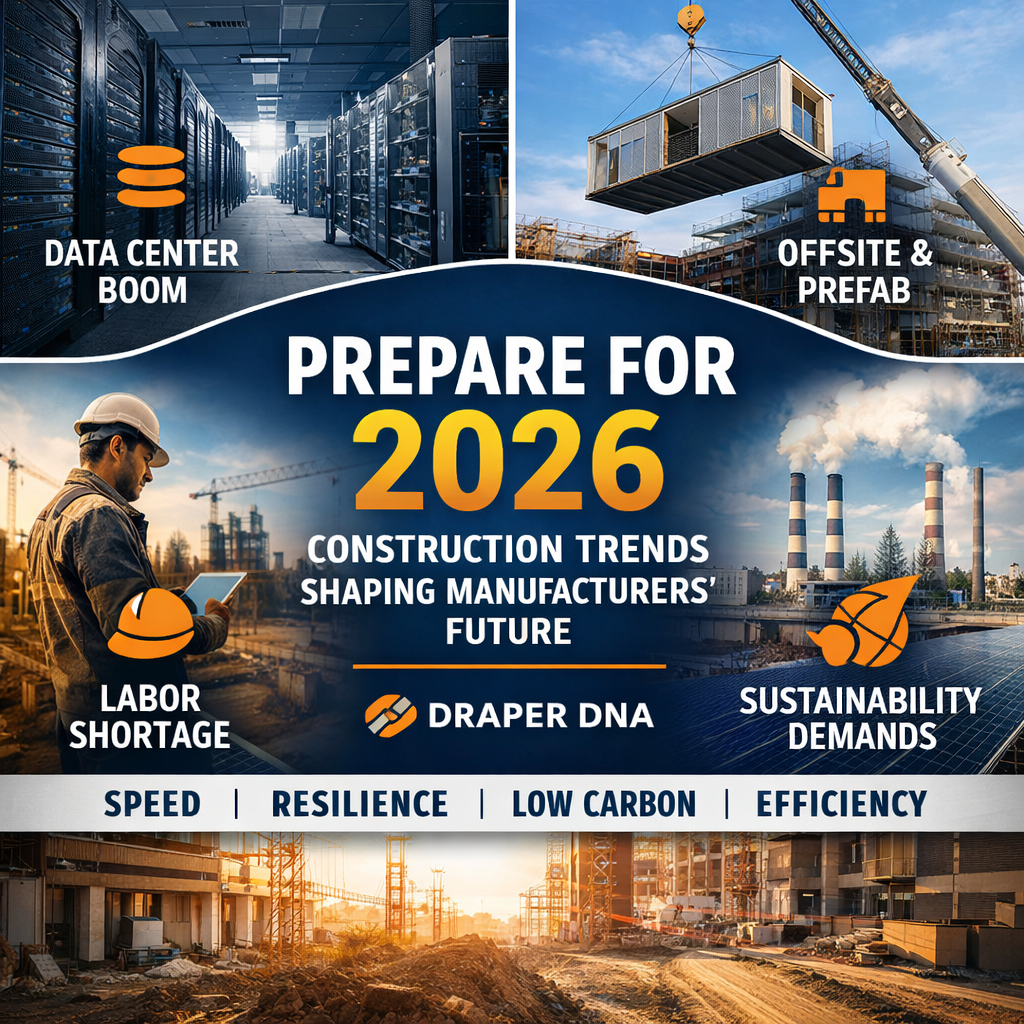

2026 Is Coming for Building Products Manufacturers (In a Hard Hat). Here’s How to Be Ready.

January 5, 2026

.

Construction is entering 2026 with a weird mix of sluggish in some “normal” sectors and on-fire in a few very specific ones. If you’re a building products manufacturer, that’s not bad news. It’s a clarity moment.

Because when markets get selective, the winners aren’t the loudest brands. They’re the brands that align product, proof, and positioning with what the market is actually buying next.

Below are the most important construction trends shaping 2026 and what they mean for building products manufacturers who want to stay off the clearance rack.

Trend 1: “Normal” construction is cautious. Megaprojects and data centers are not.

Forecasts point to modest overall growth in 2026, with selective strength concentrated in areas like data centers and other high-value megaprojects. Deloitte notes a pivot from a 2025 decline to modest growth in structures investment in 2026, with AI-related data center spending continuing to support engineering and construction activity. Deloitte

Trade press and industry outlook coverage echo the same theme: continued strength in data center construction and megaproject groundbreakings, even as other categories stay choppy. Glass Magazine+1

What this means for manufacturers

-

If you sell into “everything,” 2026 will feel like whiplash.

-

If you build targeted plays for the sectors still spending, 2026 can be a growth year.

Implications and moves

-

Package solutions for the sectors still writing checks. Data centers don’t buy “products.” They buy performance: uptime, thermal management, speed, safety, redundancy, and compliance.

-

Get serious about spec influence. When owners are spending billions, they want fewer surprises. That pushes decision-making earlier, upstream, and more spec-driven.

Trend 2: The data center boom is really an energy and infrastructure story (and it’s accelerating)

Data centers are not just multiplying. Their power demand is climbing fast. S&P Global (451 Research) forecasted U.S. data center grid power demand rising sharply in 2025 and growing substantially by 2030. S&P Global And forecasts keep getting revised upward: BloombergNEF coverage highlights scenarios where U.S. data center power demand could reach very large numbers by 2035. Utility Dive

That power hunger is already reshaping markets, from site selection to grid upgrades, and even keeping older “peaker” plants online in some regions. Reuters

What this means for manufacturers

Data center projects pull demand into very specific product needs:

-

high-performance envelopes and airtightness

-

fire and life safety systems

-

vibration, acoustics, and equipment protection

-

rapid-install interior systems

-

resilient roofing and waterproofing

-

electrical room and mechanical space buildouts

Implications and moves

-

Build a “data center-ready” spec kit. Assemblies, details, testing, preferred installers, lead times, and documentation. Make it easy for teams who want certainty.

-

Speak the owner language. Reliability and speed beat “premium” and “beautiful” every time in this segment. (Yes, even if your product is gorgeous.)

Trend 3: Industrialized construction and offsite are moving from “interesting” to “necessary”

Labor constraints plus schedule pressure equal more factory thinking: panelization, prefab MEP, volumetric components, and repeatable assemblies. The U.S. Department of Energy’s Advanced Building Construction (ABC) Initiative specifically targets integrating energy efficiency into “highly productive” construction practices, including approaches that can increase the speed and scale of delivery. The Department of Energy’s Energy.gov+1

On the housing side, research organizations like NREL are also emphasizing modular/prefabrication as a pathway to deliver affordable, energy-efficient buildings while strengthening the construction workforce. NREL

What this means for manufacturers

If your product is hard to install, inconsistent, or overly dependent on scarce skilled labor, the market will quietly start selecting you out. Not with angry emails. With fewer bids.

Implications and moves

-

Design for manufacturability and install speed. Fewer steps, fewer tools, fewer failure points.

-

Offer “system thinking,” not just components. Provide assemblies that work with offsite workflows.

-

Support fabricators and component plants. The buyer may not be a jobsite GC anymore.

Trend 4: The labor shortage isn’t easing fast enough to save you

AGC’s 2025 Workforce Survey found workforce shortages are a leading cause of project delays, with a large share of firms reporting difficulty hiring qualified workers. Associated General Contractors+1

What this means for manufacturers

Your product strategy is now labor strategy.

-

If your product reduces labor time, you’re not “nice to have.” You’re risk management.

-

If your product requires specialized labor that’s disappearing, you’re a schedule problem.

Implications and moves

-

Turn installation into a competitive advantage. Training, certification, jobsite support, and install simplification are now marketing assets, not overhead.

-

Build content for the people actually doing the work. Contractors don’t need more inspiration. They need fewer headaches.

Trend 5: Low embodied carbon requirements are becoming real procurement filters, not PR fluff

Federal procurement is pushing embodied carbon from “voluntary” into “required documentation,” starting with specific material categories. GSA’s IRA low-embodied carbon requirements explicitly cover concrete/cement, CMUs, asphalt, steel, and glass, and include thresholds and reporting expectations. U.S. General Services Administration

This is part of a broader “Buy Clean” direction, and it’s shaping market behavior: product-specific EPDs, proof of plant sourcing, and quantified global warming potential (GWP) are becoming table stakes in certain bids. Carbon Leadership Forum+1

What this means for manufacturers

Even if you’re not selling directly to federal projects, the compliance behavior spreads:

-

architects standardize on documentation-ready products

-

GCs avoid products that slow submittals

-

owners increasingly require reporting across portfolios

Implications and moves

-

Get your documentation house in order. Product-specific EPDs where relevant, clear submittal packages, and sales enablement that explains the numbers in plain English.

-

Translate sustainability into performance and risk reduction. The carbon story is persuasive. The “it makes approvals and procurement easier” story is often decisive.

Trend 6: Energy codes and electrification readiness are tightening in meaningful pockets

Codes aren’t changing everywhere at once, but they are tightening where it matters most: the bellwether states and regions that influence national manufacturing decisions.

Examples:

-

New York adopted a 2025 energy code incorporating the 2024 IECC and ASHRAE 90.1-2022, with features like enhanced envelope requirements and thermal bridge mitigation. Northeast Energy Efficiency Partnership

-

California’s 2025 Energy Code takes effect for permits starting January 1, 2026, expanding heat pump use, encouraging electric readiness, and strengthening ventilation. California Energy Commission

-

DOE has also issued determinations around ASHRAE 90.1-2022 energy efficiency improvements, which can drive adoption timelines at the state level. Federal Register

What this means for manufacturers

The 2026 buyer is more code-aware and more performance-driven. And they’re more likely to demand:

-

tighter envelopes, better air sealing strategies

-

better thermal bridging solutions

-

ventilation and IAQ performance

-

electrification-friendly infrastructure

Implications and moves

-

Compete on measurable performance. Test data, assemblies, detailing support.

-

Make your “code-ready” story simple. Not everyone wants to read a 90-page compliance guide. (Shocking, I know.)

Trend 7: Resilience is shifting from a premium upgrade to a baseline expectation

Extreme weather is pushing resilience up the priority list: wildfire, flood, wind, heat. Whether it’s code-driven, insurance-driven, or buyer-driven, the trend line is clear: resilience is becoming a mainstream expectation. IBHS+1

What this means for manufacturers

Resilience features are no longer niche. They’re a way to protect margin and defend share in high-risk regions.

Implications and moves

-

Create region-specific messaging. What sells in wildfire country is not what sells in hurricane country.

-

Prove it with third-party standards. Ratings, test methods, compliance pathways.

So what should building products manufacturers do right now?

Here’s the blunt checklist for 2026 readiness:

-

Choose your “growth lanes.” Data centers, institutional, selective retrofit, infrastructure-adjacent. Don’t pretend everything is equally hot. The American Institute of Architects+1

-

Productize speed. Offsite compatibility, labor reduction, install clarity. The Department of Energy’s Energy.gov+2The Department of Energy’s Energy.gov+2

-

Make proof a core product feature. EPDs where applicable, code documentation, test data, assemblies. U.S. General Services Administration+1

-

Modernize the story. Sustainability plus performance plus schedule plus compliance. Not a brand film with slow-motion sunsets (save that for recruiting).

-

Win upstream. Architects, owners, and engineers decide earlier when risk is high and budgets are huge.

Where Draper DNA fits (and why it matters)

Most manufacturers don’t fail in 2026 because their products are bad. They fail because the market moves and their messaging, channels, and sales enablement stay parked in 2022.

That’s the gap Draper DNA is built to close.

We help building product manufacturers:

-

identify the segments that will still spend in 2026 and what those buyers actually prioritize

-

translate product performance into spec-winning narratives and proof packages

-

build channel strategies that connect spec to site (and keep it from dying in the value-engineering inbox)

-

develop content and campaigns that make reps, dealers, and installers more effective, not just more “inspired”

If 2026 is the year construction gets more selective, your marketing can’t be generic. It has to be engineered, targeted, and credible, the same way you engineer the products.

Because the market isn’t rewarding “best.” It’s rewarding “best fit, easiest to specify, easiest to install, hardest to replace.”

And yes, that’s unfair. Construction has never cared about our feelings.

About Draper DNA

Draper DNA is a consultancy and marketing agency purpose-built for building products manufacturers. We work at the intersection of construction reality, product innovation, and market influence—helping brands win earlier in the decision cycle and stay specified through install.

Our team brings deep, hands-on experience across residential, commercial, and institutional construction, with particular strength in products that live in complex, performance-driven categories: roofing, cladding, windows and doors, insulation, interiors, structural systems, and emerging low-carbon materials. We understand how architects think, how contractors build, how dealers sell, and where good products get lost between spec and site.

What makes Draper DNA different is focus. We don’t apply generic marketing playbooks to construction. We build strategies grounded in how buildings are actually designed, approved, priced, installed, and maintained. From upstream spec positioning and technical storytelling to downstream sales enablement, channel strategy, and demand generation, our work is designed to reduce friction, accelerate adoption, and protect margin.

Draper DNA partners with manufacturers navigating real inflection points—new products, new categories, new sustainability expectations, or new go-to-market models. We help clarify where to compete, how to differentiate, and what proof the market requires to say yes.

In an industry that rewards credibility over hype, Draper DNA helps building products brands show up prepared, relevant, and hard to replace.