Construction in 2026: The Year Experience Stops Being Nice-to-Have and Becomes the Whole Game

January 11, 2025

.

Construction has always had a brutal scoreboard: did it get built, did it perform, and did it happen without lighting the budget on fire?

What’s changing heading into 2026 is how you get to “yes.” The industry is walking into a year where complexity rises, margins stay tight, and clients get pickier. The firms that win won’t be the ones with the flashiest tech demo or the loudest brand story. They’ll be the ones who can consistently deliver under pressure.

And that’s where experience matters.

Not as a vague credential. As a competitive advantage you can operationalize: better precon, fewer change orders, smarter sequencing, safer sites, tighter procurement, and crews that know how to solve problems before they become RFIs.

Let’s break down the trends you should be preparing for in 2026 and what they mean for anyone who builds for a living.

1) The market goes “two-speed”: big institutional work stays hot, while everything else fights for oxygen

If you build in the orbit of megaprojects, manufacturing, data centers, and major infrastructure, you’re likely to see sustained demand. If you’re primarily residential, light commercial, or discretionary capex, you’ll feel more price sensitivity and more scrutiny.

Industry outlooks are already signaling this split. Dodge forecasting coverage has emphasized data centers and megaprojects as major drivers even as broader starts soften. Engineering News-Record ConstructConnect similarly frames 2026 momentum around data centers and megaproject activity. ConstructConnect

Implication: You can’t run your business on “average market conditions.” You need a sector-specific strategy: which work you’re chasing, what risk profile you’ll accept, and how you’ll staff and self-perform around it.

Experience advantage: In choppy markets, owners reward reliability. Past performance, schedule credibility, and demonstrated risk control become a differentiator.

2) Residential improves—slowly—and “sales fixes” won’t beat “execution fixes”

Builder sentiment and forecasts have been pointing to modest improvement in 2026 (not a party, more like the lights come back on). NAHB has been signaling a slight gain in single-family starts after a down year, supported by easing rates and improving expectations. National Association of Home Builders+1

Implication: If you’re counting on a flood of easy projects, don’t. Customers will still be cautious. Financing will still matter. And whoever can deliver predictable schedules and reduce rework will look like a magician.

Experience advantage: The best “marketing” in a cautious housing cycle is operational excellence. Experienced teams tighten cycle time, reduce punch-list drag, and know where not to cut corners.

3) Materials pricing may look calm—until it doesn’t (tariffs and trade uncertainty are still in the room)

You can have stable pricing on paper and still get blindsided by reality: lead times, substitutions, and “that one package” that shows up 11% higher because the market moved.

Nationwide’s 2026 construction outlook highlights trade policy uncertainty and the risk of tariff-related increases showing up as inventories deplete. Nationwide Newsroom

Implication: Procurement becomes a strategy function, not a back-office task. Contract language, alternates, approved-equals, and early buy decisions will matter more.

Experience advantage: Veterans know where volatility usually hits first (MEP equipment, specialty metals, imported components) and how to structure buyout and schedules to reduce exposure.

4) Digital twins, AI, and BIM stop being “innovation” and start being baseline

By 2026, a growing share of owners and sophisticated GCs will treat modern data practices as table stakes. Deloitte’s engineering and construction outlook points to cloud-native digital twins and AI agents becoming standard as firms plan through 2026, alongside stronger data governance and workforce upskilling. Deloitte

This isn’t about buying shiny software. It’s about connecting design, field, and operations so decisions get made with evidence, not gut feel (or worse, the loudest voice in the trailer).

Implication: Expect more requirements around model-based coordination, reality capture, structured handover data, and operational outcomes. The “we’ll figure it out in the field” approach gets expensive fast.

Experience advantage: Here’s the twist: tech amplifies the best builders and exposes the sloppy ones. The firms with deep construction judgment will use AI and model workflows to prevent problems. The rest will use them to generate prettier reports about problems they still had.

5) Platform consolidation: fewer tools, more integration, and less patience for duct-tape workflows

The next step in construction tech is not more apps. It’s integrated platforms that connect BIM, scheduling, cost, sustainability reporting, and field execution.

This shift is being called out across AEC tech trend coverage for 2026, which emphasizes integration and scalable platforms over point solutions. Build in Digital

Implication: If your process depends on heroic PMs manually reconciling spreadsheets, photos, and emails, you’re paying a hidden tax every day. That tax gets bigger as projects get more complex.

Experience advantage: Experienced operators know what information actually matters. They’re the ones who can define workflows that people will follow under real jobsite stress.

6) Labor stays tight—so your training system becomes your growth system

The “find more people” strategy is not a strategy. It’s a wish.

The workforce challenge remains a consistent theme across construction outlooks, and even outside the U.S., major event-driven construction ramps are openly forecasting painful shortages. The Australian (Different market, same reality: demand spikes meet a limited pipeline.)

Implication: If you want capacity in 2026, you need a repeatable way to turn new hires into competent contributors fast. That means standardized work, clear quality checklists, mentoring, and leadership development for foremen and supers.

Experience advantage: Your best people can either be your advantage—or your bottleneck. The winning firms will extract their expertise into training, playbooks, and coaching instead of letting it live only in someone’s head.

7) Energy performance and “electrification readiness” keep moving from niche to normal

Whether the driver is regulation, incentives, owner preference, or operating cost reality, demand for energy-efficient and tech-forward features is rising. Even mainstream housing forecasting is pointing to stronger interest in energy-efficient and “tech-forward” features. Better Homes & Gardens

Implication: Expect more projects to require tighter envelopes, better detailing, higher-performing windows and doors, improved ventilation strategies, and electrical capacity upgrades. This raises the bar on coordination and sequencing, because building science punishes sloppiness.

Experience advantage: High-performance construction is unforgiving. The experienced teams who understand moisture management, air sealing continuity, and trade choreography will outperform teams who treat it like a product swap.

8) Risk management gets sharper: insurance, contracts, and “who owns the downside”

Owners, lenders, and insurers are increasingly intolerant of surprises. That means more contract scrutiny, more documentation, and more emphasis on safety and quality systems.

Implication: The bar rises for precon diligence, constructability reviews, and defensible decision-making. If your project controls are weak, you’ll feel it in claims, premiums, and disputes.

Experience advantage: Seasoned builders don’t just “build.” They manage risk before it becomes a cost code.

9) Building products manufacturers move from “vendor” to “risk partner”

Here’s the uncomfortable truth for 2026: construction outcomes will increasingly be decided before anyone steps on site. And building products manufacturers sit right in the middle of that reality.

For decades, manufacturers could live comfortably downstream. Make a good product. Ship it on time. Let the builder and installer deal with the messier parts. That model breaks down fast in a world of tighter schedules, thinner labor pools, higher performance demands, and less tolerance for error.

In 2026, manufacturers are no longer just selling materials. They’re selling certainty.

Implication: Builders, architects, and owners will gravitate toward manufacturers who reduce friction across the entire build cycle—not just at purchase.

That means:

-

Clear, defensible performance data (not marketing adjectives)

-

Reliable lead times and transparent supply chains

-

Installation guidance that actually reflects jobsite conditions

-

Technical support that understands sequencing, not just specs

-

Documentation that helps projects pass inspections, certifications, and warranty scrutiny

Manufacturers who still think their job ends at the pallet drop will quietly lose influence. The ones who show up earlier and stay involved longer will become preferred partners.

10) Spec decisions get more political—and manufacturers need to earn trust upstream

By 2026, spec decisions will be shaped by more voices and more pressure points: sustainability goals, energy codes, insurance requirements, labor constraints, and owner risk tolerance. Products won’t be evaluated in isolation. They’ll be judged on how they affect the whole system.

Implication: Manufacturers need to stop assuming the spec is a static document and start treating it like a living risk-management tool.

Architects and engineers want:

-

Products that are easy to specify and easy to defend

-

Fewer exceptions, fewer caveats, fewer “field verify” footnotes

-

Confidence that substitutions won’t blow up coordination later

Builders want:

-

Products that install predictably with real-world crews

-

Clear tolerances, forgiveness where it matters, precision where it doesn’t

-

Support when something inevitably goes sideways

Owners want:

-

Durability, warranties that hold water, and lifecycle clarity

-

Fewer callbacks and fewer surprises five years down the road

Experience advantage (for manufacturers): The brands that win in 2026 will be the ones that understand how their products behave not just in labs, but on cold mornings, rushed installs, and imperfect framing. That credibility only comes from proximity to the field.

11) Training becomes a product feature, not a nice extra

Labor shortages don’t just hurt builders. They hurt manufacturers whose products get installed incorrectly, misunderstood, or quietly swapped out for “something easier.”

In 2026, manufacturers who invest in training will protect their brands—and their spec position.

Implication: Expect growing demand for:

-

Installer certification programs that are practical, not ceremonial

-

Short, visual install guidance that works on a phone in the field

-

Sales and technical teams who can train builders, dealers, and crews—not just present slides

If your product requires above-average skill, you either lower the skill requirement through design or raise the skill level through training. There is no third option.

Experience advantage: Manufacturers who embed field experience into their training—real installs, real mistakes, real fixes—will see better outcomes and fewer warranty headaches.

12) Sustainability claims grow teeth—and manufacturers carry more of the burden

By 2026, sustainability will no longer be a feel-good checkbox. It will be audited, quantified, and challenged. Builders and designers will increasingly rely on manufacturers to supply credible data, not just aspirational language.

Implication: Environmental Product Declarations, carbon data, durability narratives, and end-of-life considerations will influence product selection more directly. Vague claims will slow projects down—or get products rejected outright.

Manufacturers who can clearly explain:

-

What their product is made of

-

How it performs over time

-

What tradeoffs it represents

…will make life easier for everyone upstream.

Experience advantage: The manufacturers who understand how sustainability intersects with constructability—weight, handling, sequencing, waste—will outperform those who treat it as a marketing silo.

13) Manufacturers who understand “experience” win loyalty, not just orders

Here’s the punchline: in 2026, the most valuable building products manufacturers won’t just sell materials. They’ll sell confidence.

Confidence that the product will show up when promised.

Confidence that it will install as expected.

Confidence that it will perform over time.

Confidence that someone knowledgeable will pick up the phone when things get complicated.

That confidence is built the same way on the manufacturing side as it is on the construction side: through experience, systems, and respect for how work actually gets done.

Final word

Construction in 2026 is not just a builder story. It’s a supply-chain story. A training story. A risk story.

Building products manufacturers who lean into that reality—who act like partners instead of vendors—will gain influence far beyond their line item on the estimate.

Those who don’t will still sell products.

Just not as many.

About Draper DNA

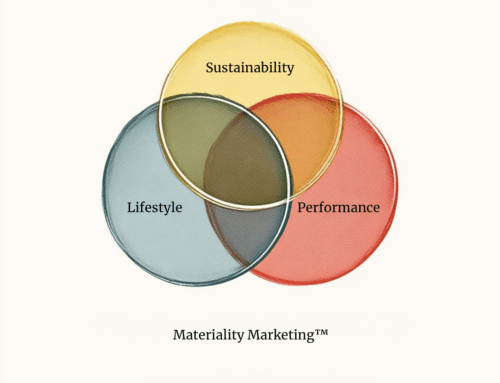

Draper DNA is a marketing and growth consultancy built specifically for building products manufacturers navigating complex construction markets.

We work with brands that live in the real world of specs, supply chains, installers, dealers, builders, architects, and homeowners—and understand that success in 2026 won’t come from louder messaging, but from smarter alignment between how products are designed, specified, sold, and installed.

Our approach blends deep industry experience with disciplined strategy. We help manufacturers clarify where they win, remove friction from the spec-to-site journey, and tell credible stories about performance, sustainability, and value—stories that hold up under scrutiny from architects, builders, and owners alike.

In a construction landscape defined by tighter labor, higher performance expectations, and less tolerance for error, Draper DNA helps manufacturers move from being “chosen” to being trusted.

Because in this industry, experience isn’t a tagline.

It’s the difference between getting specified—and getting installed.