Immigration Policy is Squeezing the Home Building Industry

June 16, 2025

Immigration Policy is Squeezing the Home Building Industry: What Builders Need to Know in Summer 2025

The U.S. housing industry is no stranger to disruption. But this summer, one of the most pressing — and often overlooked — challenges is coming straight from Washington: federal immigration policy.

Whether you’re a home builder, remodeler, or building product manufacturer, understanding how immigration enforcement and labor policy affect your business is no longer optional. It’s essential.

From framing crews to drywall teams, the home building industry runs on immigrant labor — and right now, that workforce is in short supply.

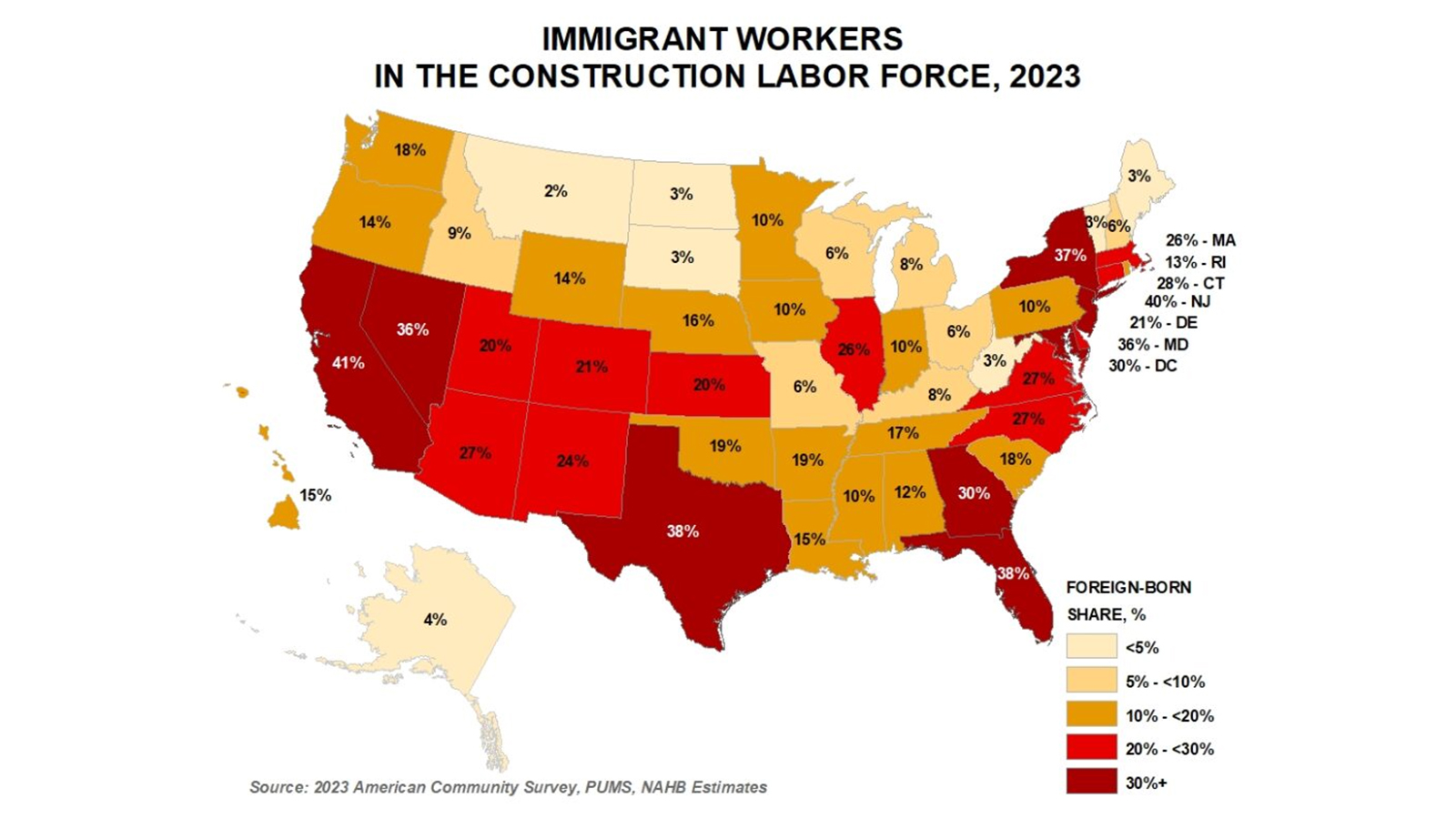

The Labor Force Reality: 1 in 3 Construction Workers Is an Immigrant

According to the National Association of Home Builders (NAHB), nearly 30% of the construction labor force in the U.S. is foreign-born. In states like California, Texas, and Florida, that number jumps above 50%. But as border enforcement tightens and visa programs lag, that labor pool is shrinking.

NAHB: Immigrant Workers in the Construction Labor Force

Direct Impacts on Builders:

- Labor shortages are growing across all trades: roofing, framing, masonry, electrical.

- Wages are rising — some markets are seeing 15–20% increases in subcontractor costs.

- Project timelines are slipping, with delays averaging 6–12 weeks on multi-home builds.

Housing Starts Are Stalling as Labor Tightens

NAHB and the U.S. Census Bureau report that new housing starts have slowed compared to early 2024 — not because of interest rates or consumer demand, but because builders simply can’t find enough skilled labor.

U.S. Census Bureau: New Residential Construction

What This Means:

- Builders are choosing higher-margin projects over affordable housing.

- Developers are pausing or canceling multi-unit builds due to cost overruns and delayed completions.

- The supply of new housing is not keeping up with demand, particularly in fast-growing regions like the Sun Belt.

Visa Backlogs and Policy Gridlock Are Driving Uncertainty

Two key visa programs affect construction labor:

- H-2B (Temporary Non-Agricultural Workers)

- EB-3 (Skilled and Unskilled Workers)

Both are facing severe backlogs, limited quotas, and inconsistent enforcement. The H-2B cap for 2025 was hit faster than ever, and there’s no sign Congress will expand the program soon.

Learn more from the U.S. Citizenship and Immigration Services (USCIS)

Builder Takeaway:

- Legal immigration pipelines for skilled labor are unreliable and outdated.

- Builders are hesitant to expand crews or invest in new projects without workforce stability.

- Labor instability is causing higher costs and lower ROI across the board.

How Builders Are Responding

Forward-thinking builders and manufacturers aren’t sitting still. Instead, they’re investing in:

- Modular construction and panelized solutions to reduce on-site labor.

- Training and apprenticeship programs to build up domestic talent (long-term ROI).

- Non-traditional recruitment pipelines, including women in trades, military veterans, and re-entry programs.

And building product manufacturers? You can play a critical role here by:

- Designing labor-efficient materials (e.g., easier-to-install systems).

- Supporting workforce education programs.

- Partnering with modular and prefab innovators to stay ahead of the curve.

What You Can Do Today

To stay competitive this summer and beyond, builders and manufacturers must:

- Monitor immigration policy and its labor implications.

- Support industry advocacy — groups like NAHB and Associated Builders and Contractors (ABC) are pushing for reform.

- Build partnerships with workforce development programs and labor-efficient product solutions.

- Innovate with labor-saving materials and construction methods.

Final Word

Immigration might seem like a political issue, but for the construction industry, it’s a bottom-line issue. The longer immigration policies remain restrictive and outdated, the harder it becomes to meet housing demand — and the more pressure lands on builders and manufacturers alike.

This summer, the message is clear: no immigration reform, no workforce relief — and that means no housing recovery.

Sources and Further Reading:

- NAHB – Housing Economics: Immigrant Construction Workforce

- U.S. Census Bureau – Residential Construction Reports

- USCIS – Work Visas and Employment Categories

- Bureau of Labor Statistics – Construction Labor Trends

At Draper DNA, we understand the unique challenges and opportunities facing today’s building products manufacturers — because we’ve lived them. With deep industry expertise, client-side experience, and a bold approach to strategy and storytelling, we help brands navigate market shifts, connect with decision-makers, and drive measurable growth. If you’re ready for a marketing partner who speaks your language and delivers results that build more than just awareness — let’s talk.