Research Report: Who is the Best on Social Media?

February 23, 2021

For the past four years, Draper DNA has worked with the research firm Rival IQ to create and present three comprehensive reports showing how building products manufacturers, architect firms and builders perform on social media. We use a list of the top 25 architectural firms, top 50 builders, and top 50 building product manufacturers as defined by trade publications. Each year it has been incredibly insightful for Draper DNA, our clients, partners, friends and prospects to learn who is the best on social media.

We were particularly curious this year as to how the results compared to last year since so much has changed with the pandemic and business models adjusting to accommodate. There were some things we suspected we would see as a result of our time on social media like Milwaukee Tools continuing to outperform the competition but also a few surprises.

Here are some other things we learned that are of value when considering a strong social media presence.

Top 25 Architectural Firms on Social Media

When it comes to architectural firms posting to social media, we saw an overall increase in activity in the second half of the year. This most likely reflects how businesses initially responded to the pandemic in the first half of the year; specifically, slowing their cadence. It also reflects how architects recognized how to use social media to reach their customers, prospects, vendors, and peers as the pandemic continues.

Cross-Channel Comparison

Cross-channel comparisons look at the performance of each business on the four platforms in the aggregate. Upon our initial review, there was a shift in who came out on top. In 2020 it was nationally recognized SOM but this year Gensler took over as the leader in four of the six measured performance categories. Overall, Gensler’s increase in engagement of 150% from 2020 is outstanding and impressive.

Engagement Amplification

Let us first define amplification and why we deem it the highest level of measured performance and accomplishment. Amplification is the sharing of the posted content by the readers to their followers. This simple act shows the support of the reader and their promotion of the content by their brand to their followers. Amplified engagement is the strongest endorsement from the readers and followers.

In terms of who led the charge in amplifying engagement with architects, Stantec took the top spot from last year’s HKSinc. Stantec posts were amplified 3.5 times more than the average firm.

Platform Breakdown

On Facebook, the engagement leader shifted from HKSinc to Jacobs in 2021. On Instagram, Gensler took the top spot from last year’s SOM as leader. For Twitter, Stantec stole the show from Jacobs. On YouTube, AECOM took the cake as IBI moved down the list. We noticed on YouTube there was a 150% increase in engagement with the same limited number of firms using the platform. This validates that video is a stronger performer and an opportunity for growth of influence.

Content

One of the reasons Jacobs has likely found success in their Facebook engagement is because they post thought leadership content from executives to their sales team. This allows for consumers to learn not just about the brand but about what is happening around the industry. It also allows for customers to get to know the team members of the firm they’re working with. By creating that voice, it brings followers back to learn more about a wide range of things as opposed to just the work that’s being done on their behalf. They also do a nice job of posting frequently which reminds guests to the page and the site that Jacobs has a lot of relevance to the industry, making them more trusted and resourceful.

Top 50 Builders on Social Media

Builders have demonstrated that they understand and appreciate the power of social media as a fast, effective, and affordable manner to connect with their customers. Our research shows the audience grew significantly. It also shows mixed efforts between asserting their social media efforts and pausing them. The builders that asserted themselves during this time found increase engagement conversations (comments).

Total Engagement

When it came to total engagement, we noticed that this is where the largest jump in numbers came from, more specifically a large increase in the second half of the year. Lennar was the leader in 2020 and this year it is Toll Brothers who is doing a nice job on Instagram and YouTube, the more visual social media outlets.

Engagement Amplification

Amplifying engagement is so important and we didn’t notice a huge shift as Lennar remains the leader in this area. We did notice the numbers didn’t changed from 2020 suggesting they have an opportunity to improve their content.

Platform Breakdown

Lennar is at the top of the list when it comes to Facebook engagement. Beazer Homes showed remarkable growth in engagement on Facebook with an 84% increase due mostly to increasing their activity. The research suggests there is an opportunity for all involved to improve their content and, in turn, improve their performance.

Toll Brothers and David Weekley Homes are high performers on Instagram. Both builders leveraged their large audiences’ size and high frequency of posting to their advantage. There is an opportunity for creative content to set a builder apart on Instagram.

Interestingly, Habitat is a clear leader in using Twitter to engage their followers. Just as interesting is the fact that Pulte Homes is a clear leader in posting volume. This shows activity on its’ own does not product results.

Toll Brothers had really great content on YouTube as can be seen by the fact that the engagement numbers are 4 times greater than they were in 2020. We believe there are some builders, like Perry Homes, who have a high volume of posts and lower engagement which suggest the need for improved content.

Content

Toll Brothers had a great year on social media. They gave their followers the opportunity to “try before they buy” through both YouTube and Instagram. On YouTube they leveraged videos that educated viewers about potential purchases before making a commitment. On Instagram they showcased beautiful interior and exterior photography with multiple photos in a single post. Their continuation of the hashtag #LoveEverythingAboutHome provides consistency and allows for followers to also post content that can be re-shared and used by Toll Brothers. Sharing makes Instagram and YouTube posters feel valued as customers.

Overall

Overall, builders do a nice job of featuring people, homes and designs within their posts. It would be advantageous, in our opinion, to add home and building products to the mix to not only support the builders’ brands but also to stand apart from the competition. It appears adding user generated content, customer service options, dedicated online communities and referrals as they build their social media plans.

Top 50 Building Product Manufacturers

As we look at the research, we see social media activity generally down from last year with the exception of the research category leaders. This is important as our research showed builders efforts generally increasing during this time.

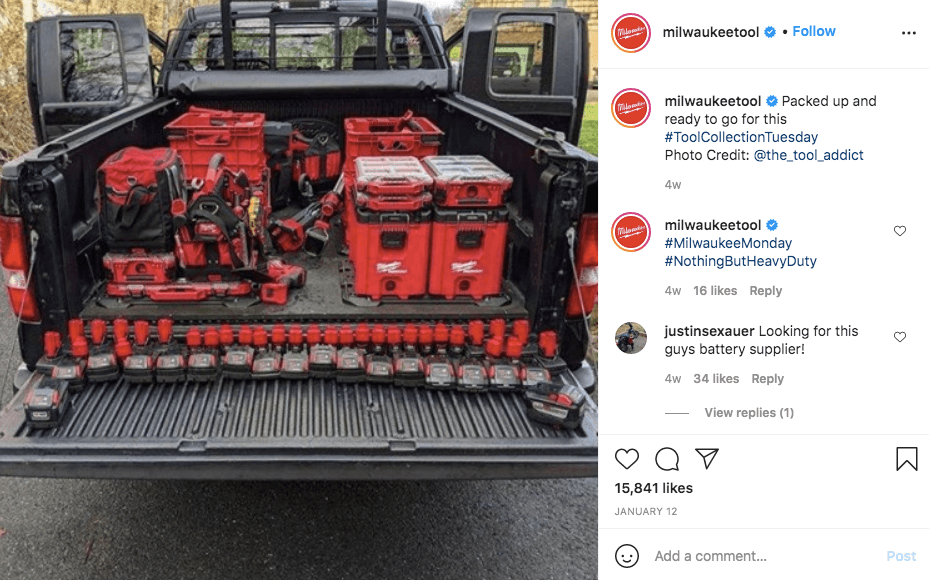

Milwaukee Tool leads in all measures of cross-channel engagement – amplification, applause, conversion, total engagement per post, and overall total engagement. The only category they are not the leader is audience size. Milwaukee Tool has been the leader all four years we have conducted and published this report.

Cross-channel comparisons

When looking at cross-channel comparisons for BPM’s year-over-year, Milwaukee Tool’s performance is dependably impressive. We believe their success is a result of creativity, having consistency in their weekly posts, and really encouraging their fan base to engage with them often. Milwaukee Tool owners are a loyal bunch and love to show off their swag!

We also noticed that there is a significant gap for the lower 42 companies, which present a large opportunity to create a plan for change. Draper DNA is of course here to help with.

Engagement Amplification

In our 2020 report, Sherwin Williams led the pack in amplification (sharing by followers). In 2021, Milwaukee Tools is the performance leader. We believe this shift may have had something to do with this year’s report not including Pinterest where Sherwin Williams uses their beautiful photography to promote its product more so than other channels.

Overall, we noticed that amplification is generally low which we know to be a huge opportunity for an improved content strategy.

Platform Breakdown

When we broke down each platform – Facebook, Instagram, Twitter and YouTube – it was clear, again, that Milwaukee Tool has a social media strategy and team that is working well. In terms of Facebook, they topped the list both in 2020 and 2021. It was a surprise to see that Pella had a noticeable drop in Facebook engagement during this reporting period. They were not alone as most BPMs reported a significant decline.

On Instagram, you guessed it, Milwaukee Tools lead the charge. It was interesting to see that overall, there was an increase in posting volume year-over-year, which is likely due to a shift in priorities during the pandemic. One brand in particular who really increased its cadence in posting is Wellborn Cabinet who is doing a nice job in creating an online community with its followers enticing them to engage more frequently.

On Twitter, this year Cambria took the lead over last year’s leader Milwaukee Tools, showing a 2.5x increase in engagement. We also noticed that a few BPM’s really took advantage of Twitter this year with Owens Corning seeing a significant increase in engagement and Makita leaping 2x in engagement numbers.

Our friends over at Milwaukee Tool held onto the top spot on YouTube with impressive numbers. The average number of engagements for the top 50 was 107; Milwaukee totaled 11,000 engagements. It was interesting to see that some brands have very high posting volume with low engagement. It may be time to consider an updated content strategy.

Content

For years, Milwaukee has been using the hashtag #ToolCollectionTuesday where they request user generated content asking their customers to show off their tool collections. When they receive a photo they clearly like, they repost that, use the same hashtag and tag the customer that has shared the photo. This gives their customers and followers a chance to communicate directly with the brand they love so much and allows for ongoing engagement. You can see from the number of likes that it’s a big hit. Smart move.

Overall Thoughts

Social media for BPMs has grown significantly in reach, influence, and overall importance. We dare say social media is the most important marketing communications tool in the marketplace. When comparing BPMs to their builder and architect customers shown in these reports, BPMs have a real opportunity to better connect with their customers in ways similar to those of these customers.

In general, we believe that the content and specifically the images that building products manufacturers are selecting to post are one many of in a sea of sameness. There is a real opportunity for more sophisticated content strategies that include user generated content and more creative posting tactics like Instagram carousels, video content, and animations. Further, we have seen retailers like Lowe’s Home Improvement use social media for communications, promotion, customer service, customer retention, and sales. The pandemic and staying at home have heightened the demand and opportunity for social media as architects, builders, and building products manufacturers. Everything suggests the importance of social media will continue to grow. We hope BPMs will follow.

What’s next?

These three reports provide insightful data into the top businesses in residential and commercial construction. Knowing how to convert this data into actionable steps is what’s next. Behind this data are hundreds of posts that tell the story of each businesses brand, content strategy, sales plans, and customer service efforts. The available information is rich with actionable insights. Please let us know if you would like to learn more.