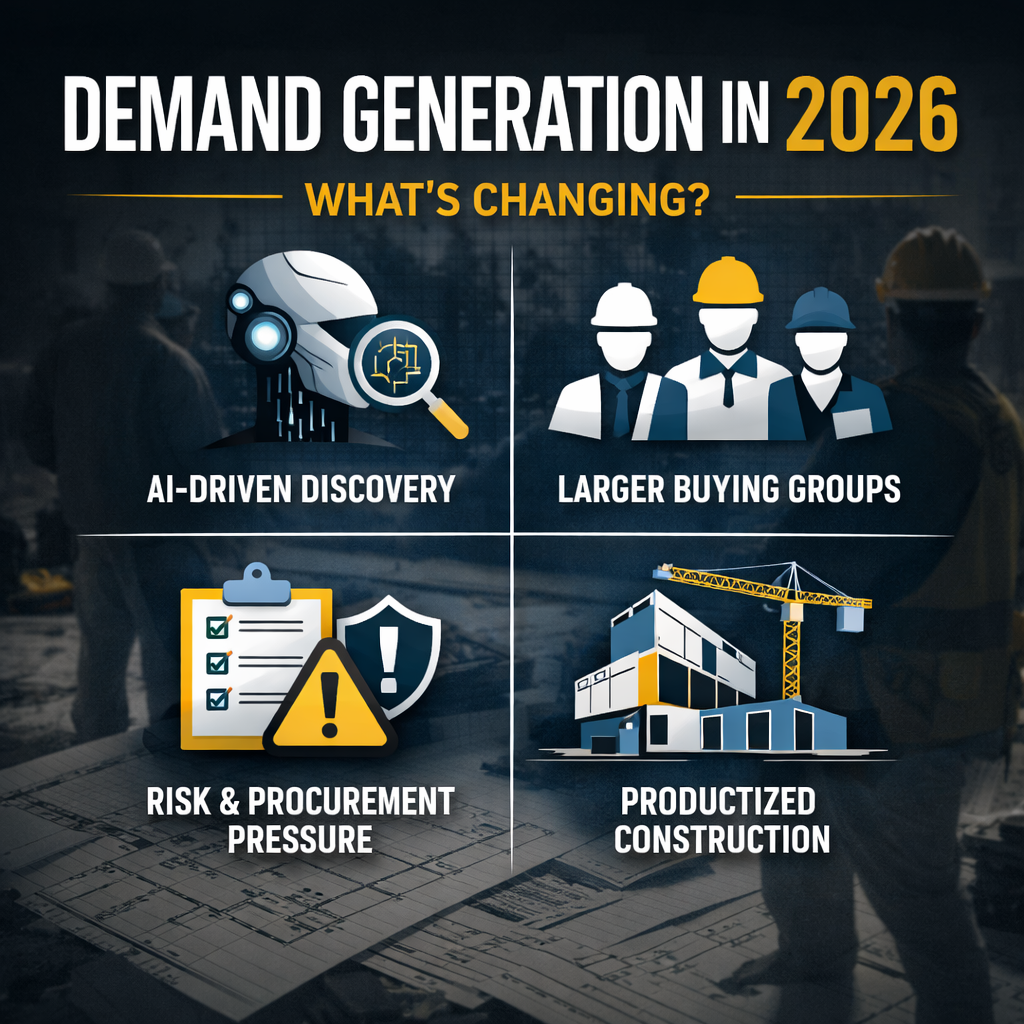

Demand Generation in 2026 for Building Products Manufacturers: What’s Changing, and What to Do About It

February 1, 2026

.

If your demand gen plan still assumes one buyer, one form fill, and one tidy linear funnel… 2026 is going to feel like showing up to a framing job with a butter knife.

Building products demand generation is getting pulled by two forces at once:

-

How AEC firms buy is changing (more scrutiny, more procurement influence, more risk management).

-

How people discover products is changing (AI-mediated search, shifting data signals, and a harder line between “interest” and “intent”).

The manufacturers who win will be the ones who treat demand gen as a system: content + digital experience + data + sales enablement + channel alignment.

Below are the trends that matter most in 2026, and how to apply them specifically to building products manufacturers selling through architects, builders, contractors, designers, and remodelers.

1) AI becomes a gatekeeper, not a helper

GenAI isn’t just making your team faster. It’s reshaping discovery. Buyers are getting answers without clicking, comparing options inside AI experiences, and shortening the “research” phase you used to rely on for nurturing.

Gartner is already signaling the shift: by end of 2026, 40% of enterprise apps will include task-specific AI agents. Translation: more workflows happen inside tools, not on your website.

And Gartner has also pointed to AI-driven experiences affecting how consumers evaluate options in search-like journeys.

Forrester is blunt: GenAI is upending business buying, buying groups are growing, procurement is more influential, and trials are becoming essential to reduce risk.

What this means for building products

-

Specs, install guidance, performance data, and warranty language will be pulled into AI answers. If your information is vague or scattered, you’ll be “invisible by default.”

-

If your competitors publish better structured content (and better proof), they’ll get recommended even when you’re technically “better.”

Do this in 2026

-

Build an AI-ready product knowledge base: structured pages for each product with use cases, assemblies, limitations, compliance references, install steps, care/maintenance, and FAQs.

-

Publish decision content, not just brand content: “Which underlayment for X roof geometry?” “What rainscreen approach for Y climate zone?” “How to detail Z interface?”

-

Create a “Proof Pack” per product line: test results, code evaluation references, sustainability documentation, warranty clarity, and field case studies.

Demand gen metric to watch

-

Growth in non-branded organic traffic to technical pages + increases in spec requests / sample requests from those pages (not just brochure downloads).

2) Buying groups get larger, procurement gets louder, and risk tolerance drops

Forrester’s 2026 buyer research highlights an environment where leaders must justify every dollar, procurement influence increases, and trials become essential to reduce risk.

Meanwhile, Deloitte’s 2026 Engineering & Construction outlook points to pressures like material costs, labor challenges, shifting demand, and continued digital transformation.

In other words: your buyer isn’t just an architect anymore. It’s the architect + contractor PM + estimator + procurement + installer + owner rep + sometimes a sustainability lead. Each one has their own definition of “good.”

What this means for building products

-

“Pretty” doesn’t close. “Proven” closes.

-

Your content has to answer risk questions early: lead times, substitution logic, labor impacts, installation error-proofing, field support, and lifecycle costs.

Do this in 2026

-

Run ABM like you mean it: target projects + firms + roles, not “construction decision makers.”

-

Add procurement-grade content:

-

lead-time transparency principles (even if not exact numbers)

-

alternates and substitutions guidance

-

packaging/logistics details that prevent site chaos

-

install time impacts and required tools

-

-

Offer low-friction trials: mockup kits, site demo days, virtual install walkthroughs, lunch-and-learns with a clear “next step” (sample, spec assist, takeoff support).

Demand gen metric to watch

-

Multi-threaded engagement in target accounts (multiple roles consuming different content) rather than single-lead MQL volume.

3) Industrialized construction and “productization” reshapes influence

AEC is moving toward repeatability, prefabrication, and productized building components as a response to cost, waste, and efficiency pressures.

Construction trend coverage is also emphasizing the macro forces shaping 2026 decision-making: costs, demand pockets (like data centers), and a market that rewards speed and predictability.

What this means for building products

-

You’re not just selling a material. You’re selling a path to predictable outcomes.

-

Demand gen content must map to systems and assemblies, not standalone products.

Do this in 2026

-

Reframe campaigns around assemblies: “High-performance wall system for multifamily,” “Moisture-managed exterior package,” “Rapid-install interior system.”

-

Build specifier tools that reduce friction:

-

detail libraries (DWG/Revit where relevant)

-

concise spec language blocks

-

“common failure points” guidance

-

-

Partner content with fabricators and installers: real-world constraints matter as much as design intent.

Demand gen metric to watch

-

Spec-in rates and “influence-to-order” tracking by assembly type, not by individual SKU.

4) The data game is shifting: it’s less about cookies, more about trust and signals

Google’s Privacy Sandbox direction and cookie changes have been in flux, and the broader signal is clear: targeting and measurement are getting harder, and privacy expectations are not going away.

Even if third-party cookies don’t disappear overnight, relying on them as the backbone of your pipeline math is a risky hobby.

What this means for building products

-

You need strong first-party data: who engaged, what they engaged with, and what they need next.

-

You need measurement that ties marketing activity to project influence and revenue, not vanity metrics.

Do this in 2026

-

Treat your website like a digital rep:

-

clear conversion paths for each audience (architect vs GC vs remodeler)

-

progressive profiling (don’t demand a life story for a PDF)

-

“next best action” content recommendations

-

-

Prioritize intent signals from:

-

spec downloads, detail-page depth, tool usage

-

sample requests and follow-up behaviors

-

training participation and certification interest

-

Demand gen metric to watch

-

Pipeline created and influenced per audience journey (architect path vs builder path vs remodeler path), not blended totals.

5) Content strategy beats content volume (and AI doesn’t fix bad strategy)

Content Marketing Institute’s 2026 insights emphasize that AI isn’t the headline. Strategy is. Many teams are using AI, but the real differentiator is a documented, useful approach that serves the audience.

What this means for building products

-

More content is not the answer. Better content architecture is.

-

Most manufacturers still underserve the “how do I avoid getting blamed for this later?” questions.

Do this in 2026

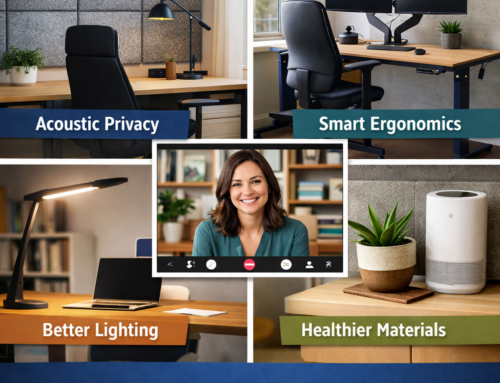

Build your content around the moments that create demand:

-

Architect moments: early concept guidance, performance comparisons, detailing support, compliance shortcuts, spec language.

-

Builder/GC moments: install speed, sequencing, labor impacts, risk reduction, warranty clarity.

-

Contractor/install moments: field guides, troubleshooting, videos that show the hard parts, training and certification.

-

Designer/remodeler moments: aesthetic options, compatibility, lead times, availability, maintenance, and consumer-friendly proof.

Then package it into campaignable programs:

-

“Specifier Confidence Series” (monthly)

-

“Field-Proven Fridays” (weekly bite-sized install wins)

-

“Assembly Deep Dives” (quarterly webinars with actual details, not fluff)

Demand gen metric to watch

-

Content-driven sales cycle compression (fewer RFIs, fewer substitutions, faster spec decisions).

6) The channels are changing: LinkedIn keeps eating budget, but trust is the real currency

B2B marketers continue to shift spend toward LinkedIn as it evolves formats and measurement that B2B teams want.

But here’s the trap: you can buy reach. You cannot buy credibility. Credibility is earned in building products, one documented detail at a time.

Do this in 2026

-

Use LinkedIn for distribution, not substitution:

-

promote proof-led content

-

drive to tools, details, and real resources

-

-

Create “expert surface area”: your technical team, field support, and product leaders should have a presence. Not influencer theater. Practical authority.

Demand gen metric to watch

-

Growth in qualified inbound tied to specific proof assets, not generic engagement rates.

A 2026 Demand Gen Blueprint for Building Products

If you want a practical order of operations:

-

Fix product data and proof (your AI and your humans need it).

-

Build audience-specific journeys (architect/builder/contractor/designer/remodeler are not the same buyer).

-

Launch ABM around projects and assemblies (not demographics).

-

Instrument first-party signals and connect them to CRM and sales activity.

-

Enable sales and channel partners with proof packs and next-step plays.

-

Measure pipeline influence by audience path, account, and project type.

That’s the difference between “we ran campaigns” and “we built demand.”

Draper DNA is a boutique consultancy and marketing agency built for the building products ecosystem. We help manufacturers turn complex products into clear, persuasive demand across the full chain: architect to builder to contractor to designer to remodeler.

If you want a demand generation program that actually fits how building products are specified, sold, distributed, and installed, Draper DNA can help you design and implement it end-to-end. That includes audience journey mapping, messaging and proof development, account-based programs, content systems, sales enablement, channel coordination, and measurement that ties activity to pipeline and revenue.

If you’re ready to build a custom demand generation program for 2026 that drives spec pull-through and sales-ready demand (not just marketing activity), reach out to Draper DNA to start with a short diagnostic and a practical roadmap tailored to your product category, channels, and growth goals.