Deep Channel Understanding: Why Distribution Fluency Defines Marketing Success for Building Products

October 9, 2025

Introduction: The Channel Maze

In building products, selling doesn’t happen in a straight line. You’re not running an e-commerce brand where the customer clicks “buy now” and a box shows up. You’re navigating a labyrinth of dealers, distributors, showrooms, contractors, and big-box retailers — each with their own incentives, pressures, and decision-making quirks.

Here’s the truth: if your marketing agency doesn’t understand the nuances of these channels, you’re going to waste spend, miss opportunities, and frustrate your partners. That’s why deep channel understanding isn’t a “nice to have.” It’s the second critical reason why building products manufacturers need an agency with true industry expertise.

Why Channels Are Different in Building Products

Let’s break it down. Unlike consumer goods, building products move through layered networks:

-

Two-Step Distribution: Manufacturer → Distributor → Dealer/Contractor → Homeowner.

-

Direct-to-Dealer: Manufacturer → Dealer → Pro/Consumer.

-

Mass Merchants: Manufacturer → Home Depot, Lowe’s, Menards → DIY + Pros.

-

Hybrid Models: Some products (like fasteners or caulk) move through multiple channels at once.

Every step introduces friction. A contractor might switch brands if stock is out at their dealer. A distributor may prioritize what moves fastest, not what performs best. A mass merchant might reduce your shelf space if your sell-through lags.

Marketing without channel insight is like trying to win chess when you don’t know how the pieces move.

What Deep Channel Understanding Really Means

1. Knowing the Economics of Each Player

-

Dealers want margin protection and pull-through programs that help pros sell.

-

Distributors want velocity and rebates that protect volume.

-

Mass Merchants want sell-through data and national brand credibility.

-

Contractors want convenience, warranties, and training support.

If your campaign doesn’t address those economics directly, it won’t stick.

2. Respecting the Power Dynamics

Let’s be blunt: distributors and dealers are gatekeepers. If they don’t believe in your product, it may never reach the jobsite. That means your marketing must simultaneously:

-

Build demand from contractors and homeowners.

-

Provide incentive and support for dealers to stock.

-

Deliver proof points that distributors can use to justify shelf space.

3. Connecting Digital and Physical Worlds

Builders may research on Instagram or YouTube, but they buy at their dealer. Homeowners may fall in love with a Pinterest board but rely on their remodeler’s recommendation. Dealers may sit in trade associations while contractors crowd Facebook groups.

Channel fluency means mapping those worlds together so messaging doesn’t die at the “last mile.”

The Draper DNA Advantage in Channels

Experience on Both Sides of the Counter

We’ve been inside the distributor’s office negotiating stocking programs. We’ve built dealer incentive programs that actually moved inventory. And we’ve stood at trade counters watching pros walk in and out with materials.

That perspective matters. It’s not theoretical — it’s field-tested.

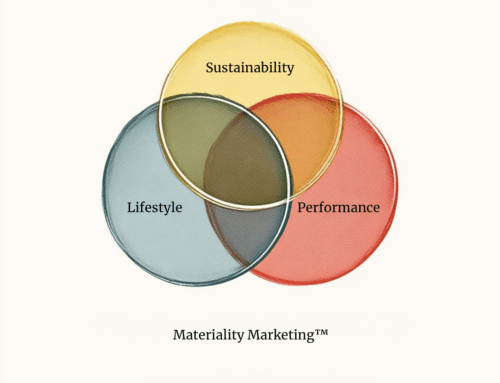

Proprietary Tools That Solve Channel Friction

-

DNA Channel Map™: Identifies exactly where your marketing message dies between manufacturer, distributor, and homeowner.

-

Spec-to-Site Framework™: Ensures products make it all the way from architectural plans to installation.

-

ProNetwork Programs: Dealer and contractor loyalty systems that tie brand preference to real benefits like leads, training, and extended warranties.

Case in Point: Channel Misfires vs. Channel Wins

Misfire Example

A roofing manufacturer spends big on homeowner awareness ads. Homeowners ask contractors for the brand, but local dealers don’t stock it. Distributors push back, saying there’s no proven demand. Result? Lost sales and wasted spend.

Channel-Win Example

A siding manufacturer launches a contractor rebate program through dealers, paired with training events. Contractors ask dealers to stock it. Dealers see faster turn. Distributors expand inventory to keep up. Result? The campaign pulls through all levels of the channel.

The Risk of Getting It Wrong

Channel blindness is expensive. Common failures include:

-

Running national campaigns that ignore regional stocking realities.

-

Promising contractors benefits that dealers can’t deliver.

-

Overinvesting in digital without supporting dealer sell-through.

-

Launching SKUs into mass merchants without the margin structure to survive resets.

These aren’t small mistakes. They can tank millions in investment and burn relationships that take years to rebuild.

Draper DNA Thought Leadership: Beyond Channel Fluency

Here’s how Draper DNA takes channel marketing to the next level:

-

We think like a dealer. We know what makes them say yes or no.

-

We partner with distributors. We understand their rebate and stocking models.

-

We bridge pro and consumer demand. Our strategies create pull-through from contractors and push-through from partners.

And unlike generalist agencies, we don’t need a crash course in how your products get to market. We already know — and we know where the gaps usually are.

Conclusion: The Channel Test

If your marketing partner can’t explain how a product moves from your plant to a homeowner’s living room — including every player and decision point in between — they’re not the right partner for you.

Deep channel understanding is the difference between campaigns that stall at distribution and campaigns that generate real, measurable growth.

Draper DNA doesn’t just understand channels. We map them, optimize them, and turn them into competitive advantage. Do your current partners do that?